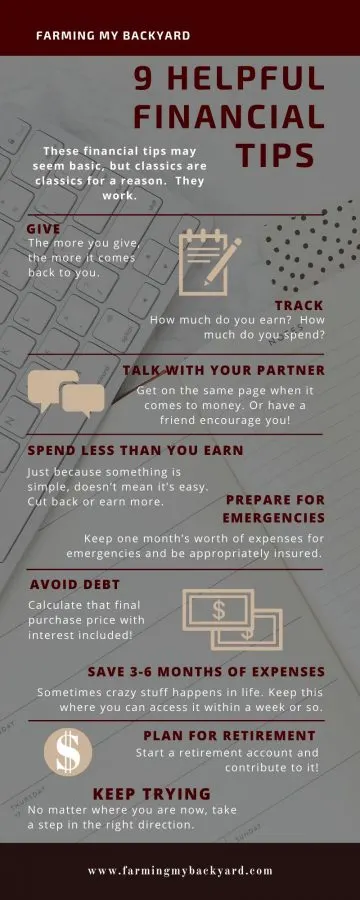

Homesteaders are generally down to earth people with a good grasp on how to live frugally. We do our best to make wise financial choices, but this is not a high paying career, and even with outside employment, sometimes we can really live “down to the wire.” Here are some financial tips that can help create a safety buffer and put you in a more secure financial position.

Financial Tips To Help You Get Ahead

Give

Some people feel that they must reach a certain level of security before being able to give back. I have found in my life, that if I waited until I had “enough” before giving, I may never have actually reached that goal. My husband and I give away 10% of our income and even when things are tight, we always make ends meet. What good is having money if we can’t improve the world with it? My personal beliefs and experiences are that the more you give, the more it comes back to you.

Record How Much You Spend and Earn

Some people call this create a budget, but I think budgets scare most of us away. We think we’ve got to have it all together and get things planned out so efficiently that we’re saving $5 a month for new clothes for next year, $15 for this, $100 for that. Then, when the numbers don’t add up, we throw the whole thing out the window and wing it.

Don’t worry about the nitty gritty details of where everything is going to go in the future. Just figure out where it went last month. How much did you earn? How much did you spend? Pick a few categories and see how much you spent in each. I like having just a few categories like housing, utilities, food (for me AND the animals), medical (vet included!), and transportation. If one of these seems unusually high I’ll delve deeper and figure out where the money went.

Once you know how you spend your money and how much you typically spend, it can be easier to predict what you might spend in future months. You may also decide to make a few changes in how you spend your money. Perhaps you realize shopping at a different grocery store would cut your food expenses. Or maybe it’s time to just stay home instead of cruising the thrift store for yet another cute shirt that you really don’t need. There are numerous financial tips on how to track your spending. You may want to try a couple of methods to see what you like.

Talk to Your Spouse

If you have a partner, you need to be on the same page when it comes to money. If you love to party and they can’t bear to buy new clothes even when theirs are full of holes, you’ve got to figure out a middle ground. Money is one of the biggest stresses in a relationship, but once you are on the same page, you can inspire each other. Reaching big goals is always easier when you have a friend to encourage you through the hard parts and to celebrate the good parts.

Spend Less Than You Earn

Classic financial tip right there.

Everybody says it and we all scoff and say “If only it were that easy.” Just because something is simple, doesn’t mean that it’s easy. Spending less than you earn can look like walking everywhere to save on gas. (Read the post Car Free With Kids). Spending less than you earn might be saying no to hanging out with friends at dinner and a movie. Or maybe it looks like selling your fridge, moving to a tiny house, or getting a second job.

Once you know where you spend your money, it’s easier to look at where it’s all going and decide if there is something you are buying that you can live without (Netflix, I’m looking at you). We all need a place to live and food to eat. The other things we may be able to get by without for a while. Or maybe you really are barely making ends meet and it’s time to start a side business selling eggs or take odd jobs on the weekends.

You can’t spend less than you earn if you don’t know how much you are spending and earning though. So make sure to keep track! It doesn’t really matter what method you use for tracking. Just use it!

Prepare for Emergencies

Some people talk about keeping a credit card for emergencies. I disagree. If you don’t have money for emergencies, how on earth are you going to afford INTEREST on that emergency? Keep one month’s worth of expenses for emergencies. This is so you can call the plumber in the middle of the night, cover an emergency room visit, or fly out of town for a funeral. Having the ability to handle urgent situations as they come up can make a huge difference in your stress level. The importance of emergency funds are huge, and it is very hard to get ahead if you don’t have one.

Another way to prepare for emergencies is to be properly insured. My husband and I have a fundamental disagreement on the purpose of insurance. He is inclined to believe that more insurance is better. I’m inclined to only get insurance for things that I cannot live without and I cannot afford to replace myself. I have to have a house, and I can’t afford to rebuild one if something happened to ours, so we have home insurance. But when they tried to upsell us on litigation insurance I looked at the laws of our state and realized that we had no assets that could legally be pursued. So we skipped that one. Likewise, we can afford to replace our cars with cash, so instead of comprehensive insurance, we pay for repairs ourselves and keep the state requirements.

If you don’t have basic insurance, you are opening yourself up for some crazy high expenses. While it may seem unlikely that you will need expensive medical care or some other disaster, things can and do happen. If you can’t pay it all in cash yourself, get insurance.

Avoid Debt When Possible

I know in my family, no sooner do we save up our emergency fund then we have something come up that depletes it. Just imagine if we were trying to do all that on credit. We’d just be falling farther and farther behind. It is very wise to avoid debt whenever possible. Oftentimes we can be lured by a manageable monthly payment amount, but how often do we take the time to calculate the final purchase price of something with the interest included?

One of the best financial tips I have followed in my life is to avoid debt. I did my best to reduce the cost of college. My family buys cars with cash or we do without. We didn’t have a credit card at all for years. Now that we do, we pay it off in full each month. If you haven’t been able to avoid debt in the past, prioritize paying it down.

Paying down debt can seem so daunting. It’s easy to get discouraged. What I did when my husband and I were trying to fix a bad situation was write all our debts on a list in the order we were going to pay them. Mostly we picked the small balances, however there were a couple very high interest rate school loans that we tackled first.

This was just a piece of scratch paper I wrote it out on. I taped it up in my bedroom closet and crossed out each debt in bright red crayon (because that’s what we had at the time). Each crossed out line was an inspiration and helped me stay focused. The fact that I saw it every morning helped me not get distracted. Years later we are still benefiting from the times when we lived extra frugally to get ahead.

What about a mortgage? Well, buying a house can either be a very smart, or a very stupid thing to do. No money down, adjustable rates, high monthly loans, long terms? Bad idea. Good interest rate, short term, large down payment, modest price? Great idea. When we bought our house in Texas, we could have gotten a lot more house or land for our money. But that wasn’t in line with our financial goals, so instead we took a house that met our needs, in a not so great area, to keep it well within our budget.

Financial Tips To Prepare For The Future

Save 3-6 months of expenses

Sometimes crazy stuff happens in life, and you get sick long terms, or you lose a job. Have 3-6 months of expenses available that you can access if needed. It doesn’t necessarily have to be in a savings account, but don’t invest this in the stock market or have it tied up in a real estate transaction. Keep it where you can access it within a week or so if the worst happens. When my husband’s father passed away, our emergency fund covered his trip out of state and the weeks he spent without working. However, it took some time before they could get access to his fathers estate, and in the meantime, funeral costs had to be paid. That is the perfect example of when this type of emergency fund comes in very handy, and I wish were more diligent about following this financial tip then.

Plan for Retirement

It was years before the concept of retirement accounts didn’t completely confuse me. If the wash of letters and numbers don’t make any sense to you, take some time to learn what they all mean. Head down to the local library and pick out a few books. Dave Ramsey, that household name of finance has a few that are good primers.

Once you get a basic idea of how it all works, start a retirement account if you haven’t already. Us homestead types can frequently be self employed. Look into an IRA and see if that’s a good fit for your situation. If you have traditional employment, find out if your have an employer match. Often times your employer will contribute a certain percentage into your retirement account if you do. If you have this benefit, contribute as much as you can to get the full match. That’s free money right there.

Once you have an account all set up, it’s time to put money in it. The conventional number is save 10 percent of your income. There are retirement calculators online where you can put in your numbers and see how much money you will have at retirement at that rate.

Luckily, there is no limit on how much you can save. A current movement called FIRE (Financial Independence Early Retirement) is based on investing much higher percentages, such as fifty percent in order to become job independent sooner. Mr. Money Mustache is a great resource to look into, if you are new to the FIRE community.

One thing that sometimes discourages people from investing is that perception that it is risky. All investments carry an element of risk, but that can be mitigated if you understand what you are doing. Don’t invest money that you need to live on, and choose reputable, well established institutions to invest with. It’s possible to trust others, but also find out all the facts, details, and take your time when planning out these important decisions.

Use wisdom when making plans for the future, but don’t operate out of fear. Fear is rarely a good guide. If you don’t feel like you understand enough to make wise decisions in investments, take time to learn more! Your local library most likely has a slew of books on investments. Read a few, because every individual has a slightly different opinion. The best advice comes from multiple people.

Keep Going

Life is rarely a linear process. Mostly likely your current needs will change, and you may need to revisit some financial tips that you once had mastered. No matter where you are now, take a step in the right direction. If you’re sitting pretty, count your blessings, and pay attention so you stay that way.

These financial tips may seem basic, but classics are classics for a reason. They work.

Want To Raise Happy Chickens?

Subscribe for our newsletter and get the free email course Intro To Backyard Chickens as well as a free printable checklist to walk you through step by step!